-

How risky is it to give card details over the phone and how do I reduce the chance of fraud?

Paul Haskell-Dowland, Edith Cowan University and Ismini Vasileiou, De Montfort UniversityPaying for things digitally is so common, most of us think nothing of swiping or tapping our card, or using mobile payments. While doing so is second nature, we may be more reluctant to provide card details over the phone.

Merchants are allowed to ask us for credit card details over the phone – this is perfectly legal. But there are minimum standards they must comply with and safeguards to protect consumer data.

So is giving your card details over the phone any more risky than other transactions and how can you minimise the risks?

How is my card data protected?

For a merchant to process card transactions, they are expected to comply with the Payment Card Industry Data Security Standard. This is a set of security requirements designed to protect cardholder data and the trillions of dollars of transactions each year.

Compliance involves various security measures (such as encryption and access controls) together with strong governance and regular security assessments.

If the information stored by the merchant is accessed by an unauthorised party, encryption ensures it is not readable. That means stealing the data would not let the criminals use the card details. Meanwhile, access controls ensure only authorised individuals have access to cardholder data.

Though all companies processing cards are expected to meet the compliance standards, only those processing large volumes are subject to mandatory regular audits. Should a subsequent data leak or misuse occur that can be attributed to a compliance failure, a company can be penalised at levels that can escalate into millions of dollars.

These requirements apply to all card transactions, whether in person, online or over the phone. Phone transactions are likely to involve a human collecting the card details and either entering them into computer systems, or processing the payment through paper forms. The payment card Security Standards Council has detailed guides for best practice:

A policy should be in place to ensure that payment card data is protected against unauthorised viewing, copying, or scanning, in particular on desks.

Although these measures can help to protect your card data, there are still risks in case the details are misplaced or the person on the phone aren’t who they say they are.

Basic tips for safe credit card use over the phone

If you provide card details over the phone, there are steps you can take to minimise the chance you’ll become the victim of fraud, or get your details leaked.

1. Verify the caller

If you didn’t initiate the call, hang up and call the company directly using details you’ve verified yourself. Scammers will often masquerade as a well-known company (for example, an online retailer or a courier) and convince you a payment failed or payment is needed to release a delivery.

Before you provide any information, confirm the caller is legitimate and the purpose of the call is genuine.

2. Be sceptical

If you are being offered a deal that’s too good to be true, have concerns about the person you’re dealing with, or just feel something is not quite right, hang up. You can always call them back later if the caller turns out to be legitimate.

3. Use secure payment methods

If you’ve previously paid the company with other (more secure) methods, ask to use that same method.

4. Keep records

Make sure you record details of the company, the representative you are speaking to and the amount being charged. You should also ask for an order or transaction reference. Don’t forget to ask for the receipt to be sent to you.

Check the transaction against your card matches the receipt – use your banking app, don’t wait for the statement to come through.

Cancelling your card is a hassle, but it’s the best way to prevent further funds being stolen from your account. Eduardo Soares/Unsplash Virtual credit cards

In addition to the safeguards mentioned above, a virtual credit card can help reduce the risk of card fraud.

You probably already have a form of virtual card if you’ve added a credit card to your phone for mobile payments. Depending on the financial institution, you can create a new credit card number linked to your physical card.

Some banks extend this functionality to allow you to generate unique card numbers and/or CVV numbers (the three digits at the back of your card). With this approach you can easily separate transactions and cancel a virtual card/number if you have any concerns.

What to do if you think your card details have been compromised or stolen?

It’s important not to panic, but quick action is essential:

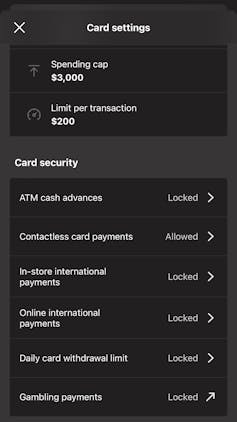

Example credit card restrictions in a banking app. Author provided call your bank and get the card blocked so you won’t lose any more money. Depending on your situation, you can also block/cancel the card through your banking app or website

report the issue to the police or other relevant body

monitor your account(s) for any unusual transactions

explore card settings in your banking app or website – many providers allow you to limit transactions based on value, restrict transaction types or enable alerts

you may want to consider registering for credit monitoring services and to enable fraud alerts.

So, should I give my card details over the phone?

If you want to minimise risk, it’s best to avoid giving card details over the phone if you can. Providing your card details via a website still has risks, but at least it removes the human element.

The best solution currently available is to use virtual cards – if anything goes wrong you can cancel just that unique card identity, rather than your entire card.

Paul Haskell-Dowland, Professor of Cyber Security Practice, Edith Cowan University and Ismini Vasileiou, Associate Professor, De Montfort University

This article is republished from The Conversation under a Creative Commons license. Read the original article.